The smart Trick of Clark Wealth Partners That Nobody is Discussing

The 3-Minute Rule for Clark Wealth Partners

Table of ContentsClark Wealth Partners for BeginnersFacts About Clark Wealth Partners UncoveredGetting The Clark Wealth Partners To WorkFacts About Clark Wealth Partners UncoveredTop Guidelines Of Clark Wealth PartnersWhat Does Clark Wealth Partners Do?Rumored Buzz on Clark Wealth PartnersThe Best Strategy To Use For Clark Wealth Partners

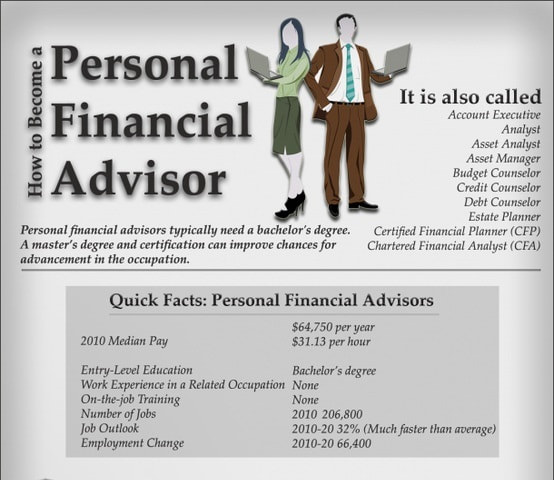

There's no single route to ending up being one, with some people starting in banking or insurance coverage, while others start in accounting. A four-year degree provides a solid structure for professions in investments, budgeting, and client services.Lots of ambitious organizers spend one to 3 years constructing these functional skills. The examination is supplied 3 times each year and covers locations such as tax obligation, retirement, and estate planning.

Typical examples include the FINRA Series 7 and Collection 65 tests for safeties, or a state-issued insurance policy certificate for selling life or medical insurance. While qualifications might not be legally needed for all preparing functions, employers and clients frequently view them as a standard of professionalism. We look at optional credentials in the following section.

8 Easy Facts About Clark Wealth Partners Shown

Most economic planners have 1-3 years of experience and familiarity with financial products, conformity requirements, and direct customer communication. A solid instructional history is necessary, however experience shows the ability to use theory in real-world settings. Some programs integrate both, allowing you to complete coursework while making monitored hours via teaching fellowships and practicums.

Numerous enter the field after operating in financial, accounting, or insurance policy, and the shift requires determination, networking, and typically advanced credentials. Early years can bring long hours, stress to construct a customer base, and the demand to continually prove your expertise. Still, the job provides strong long-lasting possibility. Financial coordinators enjoy the chance to function very closely with clients, guide essential life decisions, and usually accomplish versatility in timetables or self-employment (financial advisor st. louis).

Top Guidelines Of Clark Wealth Partners

The yearly mean income for these professionals was $161,700 as of 2024. To come to be a monetary organizer, you generally need a bachelor's degree in finance, economics, service, or a related subject and several years of appropriate experience. Licenses might be called for to market protections or insurance, while qualifications like the CFP improve reputation and profession possibilities.

Optional qualifications, such as the CFP, commonly call for added coursework and screening, which can extend the timeline by a pair of years. According to the Bureau of Labor Stats, personal monetary experts make a typical yearly yearly income of $102,140, with leading earners making over $239,000.

How Clark Wealth Partners can Save You Time, Stress, and Money.

will certainly retire over the following decade. To fill their footwear, the country will need even more than 100,000 new monetary experts to enter the market. In their everyday job, financial consultants handle both technological and creative tasks. U.S. Information and Globe Report rated the duty amongst the top 20 Ideal Business Jobs.

Helping individuals achieve their monetary objectives is a monetary consultant's key function. They are also a tiny service owner, and a section of their time is dedicated to managing their branch office. As the leader of their method, Edward Jones monetary consultants require the leadership abilities to work with and manage personnel, as well as business acumen to produce and execute an organization technique.

Not known Facts About Clark Wealth Partners

Continuing education and learning is a required component of keeping an economic consultant certificate - https://justpaste.it/js7e3. Edward Jones economic advisors are encouraged to seek extra training to widen their expertise and abilities. Commitment to education protected Edward Jones the No. 17 place on the 2024 Training pinnacle Honors listing by Educating publication. It's likewise a great idea for economic experts to attend market seminars.

That suggests every Edward Jones partner is free to concentrate 100% on the customer's benefits. Our collaboration structure is collective, not competitive. Edward Jones monetary consultants enjoy the assistance and camaraderie of other financial advisors in their region. Our economic consultants are motivated to use and receive support from their peers.

Clark Wealth Partners Can Be Fun For Everyone

2024 Lot Of Money 100 Best Firms to Help, released April 2024, research study by Great Places to Function, data since August 2023. Settlement attended to making use of, not getting, the rating.

When you require assistance in your economic life, there are several experts you may look for guidance from. Fiduciaries and financial experts are two of them (financial advisor st. louis). A fiduciary is an expert who manages cash or home for various other celebrations and has a lawful obligation to act just in their customer's benefits

Financial consultants should arrange time every week to meet brand-new people and capture up with individuals in their round. The financial solutions industry is greatly regulated, and regulations transform often. Numerous independent economic advisors spend one to two hours a day on conformity tasks. Edward Jones try these out financial consultants are lucky the office does the hefty lifting for them.

Excitement About Clark Wealth Partners

Proceeding education and learning is a needed part of maintaining a monetary consultant permit. Edward Jones financial consultants are encouraged to seek additional training to broaden their knowledge and skills. Dedication to education protected Edward Jones the No. 17 spot on the 2024 Educating pinnacle Awards list by Training magazine. It's also an excellent concept for monetary experts to go to industry conferences.

That means every Edward Jones affiliate is complimentary to concentrate 100% on the client's finest passions. Our collaboration structure is joint, not affordable. Edward Jones monetary experts delight in the support and camaraderie of other financial advisors in their area. Our economic advisors are urged to offer and receive support from their peers.

2024 Ton Of Money 100 Finest Business to Benefit, released April 2024, study by Great Places to Function, information since August 2023. Compensation offered utilizing, not acquiring, the score.

The smart Trick of Clark Wealth Partners That Nobody is Discussing

When you require aid in your monetary life, there are several specialists you might seek guidance from. Fiduciaries and economic consultants are 2 of them. A fiduciary is a professional that handles money or building for other parties and has a lawful obligation to act just in their client's benefits.